Note: Due to the promise to pay made by the foreign bank, a letter of credit offers the exporter greater surety than documentary collection. The bank will complete payment even if the importer is not able or willing to. In the case of a confirmed letter of credit, we provide you, as the exporter, with an additional promise of payment.

As the importer, you receive assurance that payment will only be made to the exporter upon presentation of the required documentation. You have significant influence over the transaction, as you define the conditions for the letter of the credit from the outset, such as delivery dates and shipment methods. As the importer, you make payment only after the goods have been shipped, and not in advance. A deferred letter of credit even allows you to pay the amount due from the revenue earned from the sale of the goods imported. You can therefore maintain your liquidity and avoid the costs associated with financing the purchase. As the exporter, the letter of credit gives you the certainty that the importer’s bank will complete payment upon presentation of the required documents even if the importer cannot or will not pay.

Confirmation

In the case of a confirmed letter of credit, we provide an additional promise of payment – over and beyond the promise made by the importer’s bank. This protects you against default on the part of the foreign bank and against political risks abroad. Upon presentation of the required documents, there are therefore three legal entities that have undertaken to pay you: the importer, the importer’s bank, and ourselves.

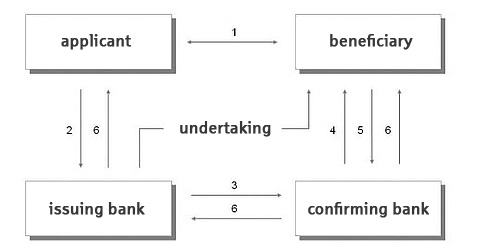

Simplified confirmed letter of credit process

- Conclusion of a contract for the supply of goods between exporter and importer.

- The importer instructs their bank to open a letter of credit. The issuing bank verifies the importer’s credit rating, and opens a letter of credit.

- The issuing bank sends the letter of credit to the exporter’s bank requesting confirmation.

- The confirming bank verifies the credit rating of the issuing bank and notifies the exporter that a letter of credit has been opened and confirmed.

- Following shipment of goods from exporter to importer, the exporter presents the required documents to the confirming bank.

- After presentation of documents in compliance with the letter of credit, the agreed amount is paid to the exporter. At the same time, the documents are presented by the confirming bank to issuing bank, and from there to the importer.