- You can accelerate your outgoing payments and take advantage of discounts for early payment.

- No conversion losses for purchases or sales incurred when credited to or debited from your usual euro account.

- No losses through duplication of margins when both outgoing and incoming payments are in a foreign currency.

- The foreign-currency account forms the basis for trading in foreign currencies.

Spot foreign exchange

Using your foreign currency account, you can make foreign currency purchases and sales on the spot market. Spot transactions are purchase and sale orders that must be fulfilled within two days.

For example, if you were to sell US dollars from your foreign exchange account then the equivalent value in euros would be available in your euro-denominated account in two working days. The exchange rate is agreed between yourself and ourselves by phone on the day the contract is placed.

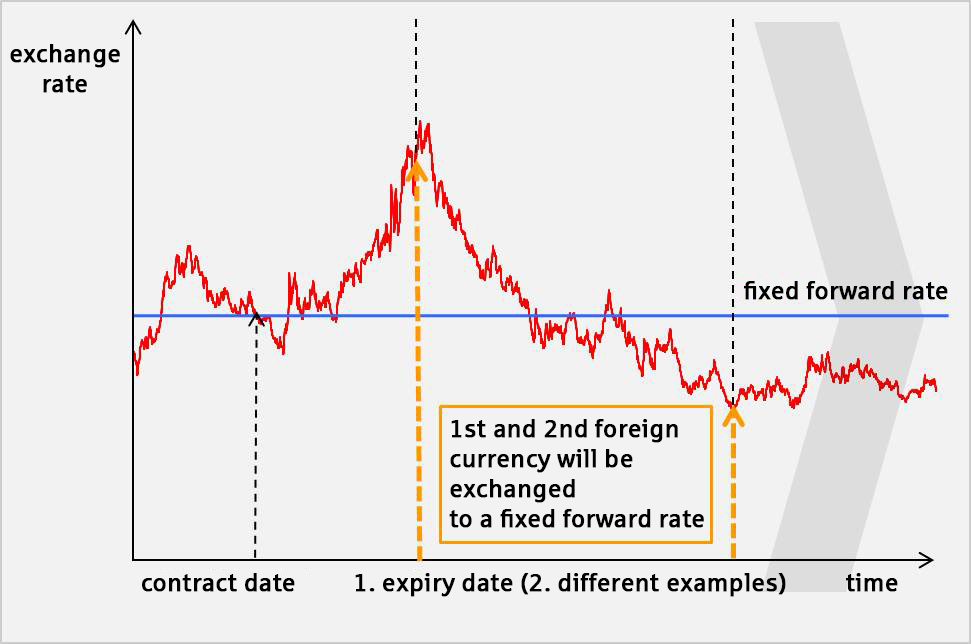

Forward exchange transaction

Is your incoming or outgoing foreign currency payment scheduled for a future date, but you want protection against possible exchange rate fluctuations?

Then it is advisable to buy or sell the foreign currency by means of a forward exchange transaction, based on a rate determined today for a specific date in the future. This gives you budgetary certainty. Forward transactions are purchases or sales that will take place on a defined future date, with at least three working days between the contract being agreed and contract fulfillment.

In other words, as an exporter, for instance, you would agree the exchange rate today for the future sale of a foreign currency to us as your bank, protecting (hedging) your future incoming payment against potential exchange rate fluctuations.

Moreover, you can also secure a forward exchange rate not just for a specific date but for an entire period by including a corresponding option. It is also possible to exercise the option in tranches, with the full amount exchanged by the option expiry date.

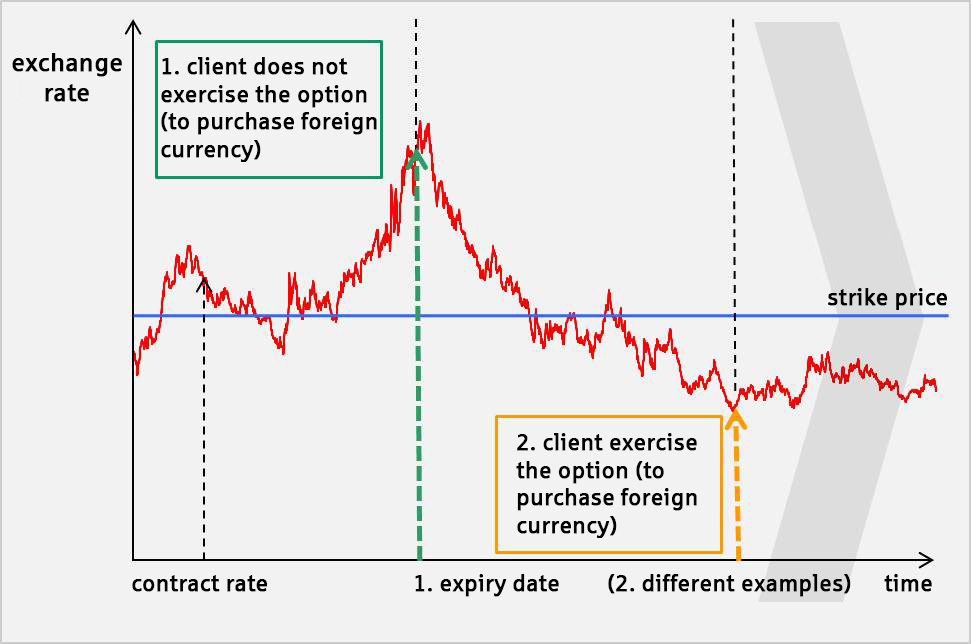

Foreign exchange options trading

You want budgetary certainty for your foreign-currency transactions, but would like to benefit from positive currency exchange movements? Are you willing to pay a price for this opportunity?

By paying a premium, you can buy an option that grants you the right to buy (call) or sell (put) a defined amount of foreign currency at a future date agreed when taking out the option. To gain this right, the option buyer pays the option seller a premium. As the buyer, you would only exercise the option when the agreed exchange rate is favorable. Where this is not the case, you can allow the option to elapse, and purchase the foreign exchange at the market (spot) price, benefiting from the improved exchange rate.